BOP Car Loan Calculator for New and Used Cars

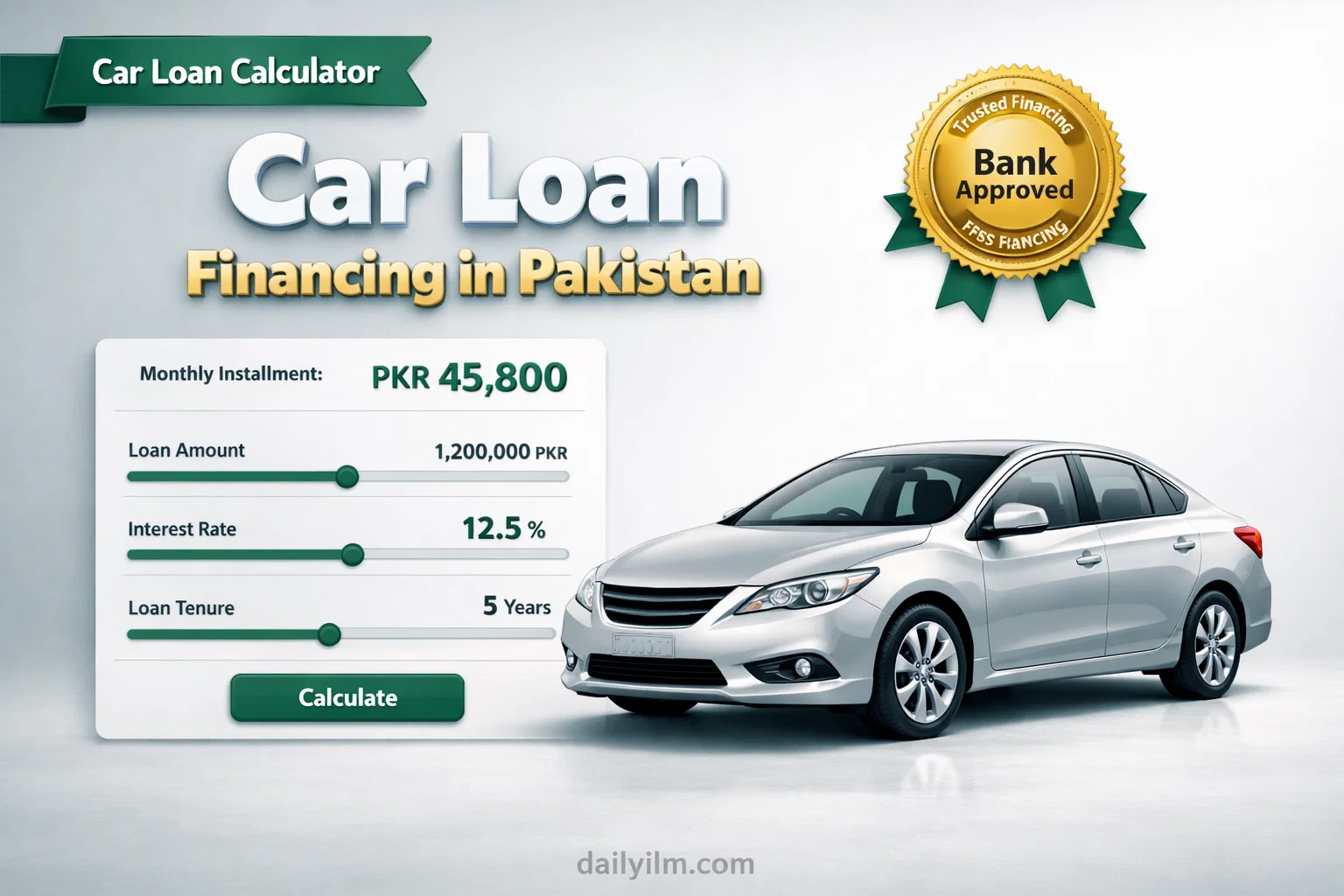

This is a practical update for people in Pakistan who are planning to buy a car on installments. The Bank of the Punjab has introduced an online BOP Car Loan Calculator that helps applicants estimate monthly installments and interest before applying.

The calculator is designed for government employees, salaried individuals, and business owners. Instead of guessing costs, users can now see a realistic installment plan based on price, tenure, and markup.

The purpose of the Bank of Punjab car financing program is simple: make car ownership possible for people who cannot pay the full amount upfront.

What the BOP Car Loan Scheme Offers

Under the BOP Car Loan Scheme, applicants can finance new and used vehicles through structured installment plans. The bank supports both locally manufactured and selected imported vehicles, subject to its policy and verification process.

The financing period generally ranges from one year to five years, allowing borrowers to choose a tenure that matches their income and repayment capacity.

This scheme is available to:

- Government employees

- Salaried professionals

- Small and large business owners

The calculator helps these groups compare installment amounts before committing to a loan application.

How the BOP Car Loan Calculator Helps

The BOP Car Loan Calculator allows users to:

- Estimate monthly installments

- Check the impact of down payment

- Compare different loan tenures

- Understand approximate markup costs

By adjusting values in the calculator, applicants can decide whether the car price and installment plan fit their monthly budget. This step is important before visiting a branch or submitting documents.

Additional Support Through Barwaqt Loan

For applicants who need short-term financial support, the Bank of Punjab also offers the Barwaqt digital loan, which can provide quick financing for urgent needs. In some cases, this facility is used alongside car purchase planning to manage initial expenses.

Eligibility, limits, and repayment terms for Barwaqt are separate and must be checked through official Bank of Punjab channels.

Important Advice Before Applying

Before applying for any car financing scheme, applicants should:

- Use the calculator to estimate installments

- Review official markup rates

- Confirm vehicle eligibility

- Understand insurance, tracker, and documentation requirements

The calculator provides estimates only. Final figures are confirmed by the bank after verification.

The BOP Car Loan Calculator is a useful planning tool for anyone considering a car loan in Pakistan. It helps applicants make informed decisions instead of relying on assumptions.

For accurate and updated information, always verify details through official Bank of Punjab sources before proceeding with any financial commitment.

Frequently Asked Questions

What is the BOP Car Loan Calculator?

The BOP Car Loan Calculator is an online tool that helps users estimate monthly installments for car financing offered by the Bank of the Punjab based on price, down payment, tenure, and markup rate.

Who can use the BOP Car Loan Calculator?

The calculator can be used by government employees, salaried individuals, and business owners who are considering car financing through the Bank of the Punjab.

Does the calculator show the final loan amount?

No. The calculator only provides an estimate. The final loan amount, markup, and installment schedule are confirmed by the bank after document verification and approval.

Can I calculate installments for used cars?

Yes. The calculator supports both new and used cars, subject to the bank’s eligibility criteria for vehicle age, model, and condition.

What loan tenure options are available?

Car financing tenure usually ranges from one year to five years. Exact tenure options depend on the applicant’s profile and the vehicle type.

Is the calculator only for government employees?

No. While government employees are eligible, the calculator is also intended for salaried professionals and business owners across Pakistan.

Are insurance and tracker charges included in the calculator?

Some calculators allow add-on costs like insurance or tracker fees to be estimated. However, actual charges may vary and are finalized by the bank.

Is using the BOP Car Loan Calculator free?

Yes. The calculator is a free planning tool and can be used without registration or payment.

I am Rashid Javed, an Author with 8 years of experience at Dailyilm.com. Master’s in Literacy, Sociology, and Social Sciences. Passionate about insightful, trustworthy content for readers.