Whether you want to start a new business or expand an existing one, PMYLS offers flexible loan options tailored to suit diverse needs, ensuring Pakistan’s youth are equipped to achieve their goals.

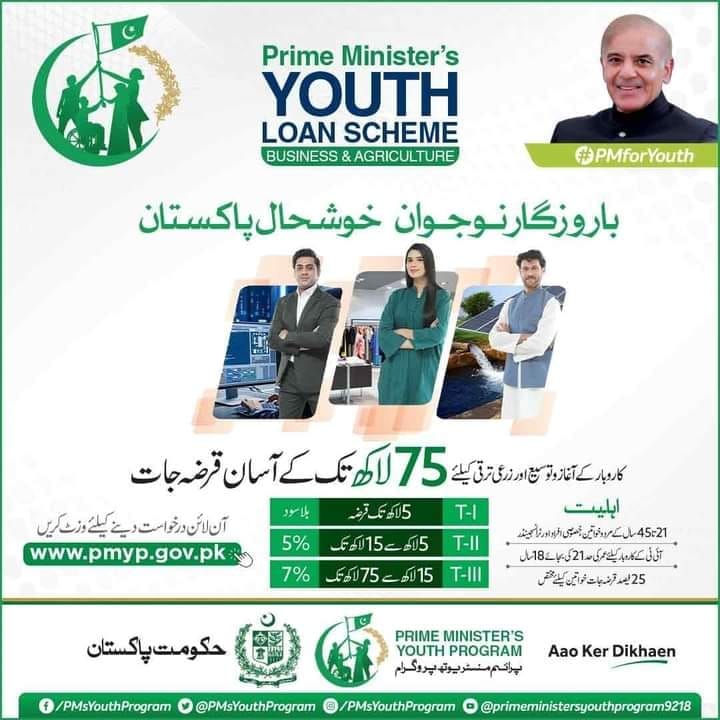

Eligibility Criteria For Youth Loan

To ensure fair access and transparency, the PMYLS has a clear set of eligibility requirements. Applicants must meet the following conditions:

- Age Limit: Applicants must be between 21 and 45 years old.

- Citizenship: Only Pakistani nationals are eligible.

- Valid Documentation: A valid CNIC (Computerized National Identity Card) or B-form is mandatory.

- Business Plan: Submission of a feasible business plan is required.

- Clean Financial Record: Applicants must not be defaulters of any government loan.

This inclusive framework ensures equal opportunities for aspiring entrepreneurs, regardless of their background or location in Pakistan.

Loan Categories and Interest Rates

The PMYLS offers three distinct loan tiers designed to cater to various financial needs. Each tier has unique loan limits and interest rates:

- Tier I: Loans up to Rs. 500,000 at 0% interest.

- Tier II: Loans ranging from Rs. 500,000 to Rs. 1,500,000 with a 5% interest rate.

- Tier III: Loans from Rs. 1,500,000 to Rs. 7,500,000 at a 7% interest rate.

These flexible options ensure accessibility for small, medium, and large-scale business ventures, making PMYLS a vital tool for fostering entrepreneurship in Pakistan.

How to Apply

Applying for the Prime Minister’s Youth Loan Scheme is simple and streamlined to minimize barriers. Here’s a step-by-step guide:

- Visit the Official Website: Go to the Prime Minister’s Youth Program (PMYP) website.

- Fill Out the Online Form: Complete the online application form with accurate details.

- Submit Required Documents: Upload your business plan and any supporting documents as specified.

- Await Processing: Applications are reviewed based on feasibility and eligibility.

The digital application process reduces paperwork and ensures accessibility for applicants across Pakistan.

Frequently Asked Questions (FAQs)

1. What is the Prime Minister’s Youth Loan Scheme (PMYLS)?

PMYLS is a government initiative providing interest-free or low-interest loans to individuals aged 21-45 to start or expand businesses.

2. Who is eligible for the PMYLS?

Eligibility includes Pakistani nationals aged 21-45 with a valid CNIC, a feasible business plan, and no prior defaults on government loans.

3. What are the loan amounts and interest rates?

The program offers loans in three tiers:

- Tier I: Up to Rs. 500,000 (0% interest)

- Tier II: Rs. 500,000–1,500,000 (5% interest)

- Tier III: Rs. 1,500,000–7,500,000 (7% interest)

4. How do I apply for a loan?

Applicants can apply online through the PMYP website by submitting a form, business plan, and necessary documents.

Why the Prime Minister’s Youth Loan Scheme Matters

Access to affordable financing is a significant challenge for young entrepreneurs in Pakistan. PMYLS addresses this gap by providing tailored financial solutions that enable business growth. From tech startups in urban centers to agricultural ventures in rural areas, the scheme supports innovation and employment generation across various sectors.

By promoting self-employment, the initiative boosts individual prosperity but also contributes to national economic development. It is a cornerstone of the government’s vision to empower the youth and foster sustainable growth.

The Prime Minister’s Youth Loan Scheme is more than a financial program; it is a beacon of hope for Pakistan’s youth. By offering affordable loans with minimal barriers, it encourages innovation, creates jobs, and strengthens the nation’s economy.

Ali Arshad is the article writer of Dailyilm.com, a platform dedicated to providing the latest news, educational resources, and informative articles. My mission is to make quality information accessible to all and empower people with the knowledge they need to stay informed and inspired.